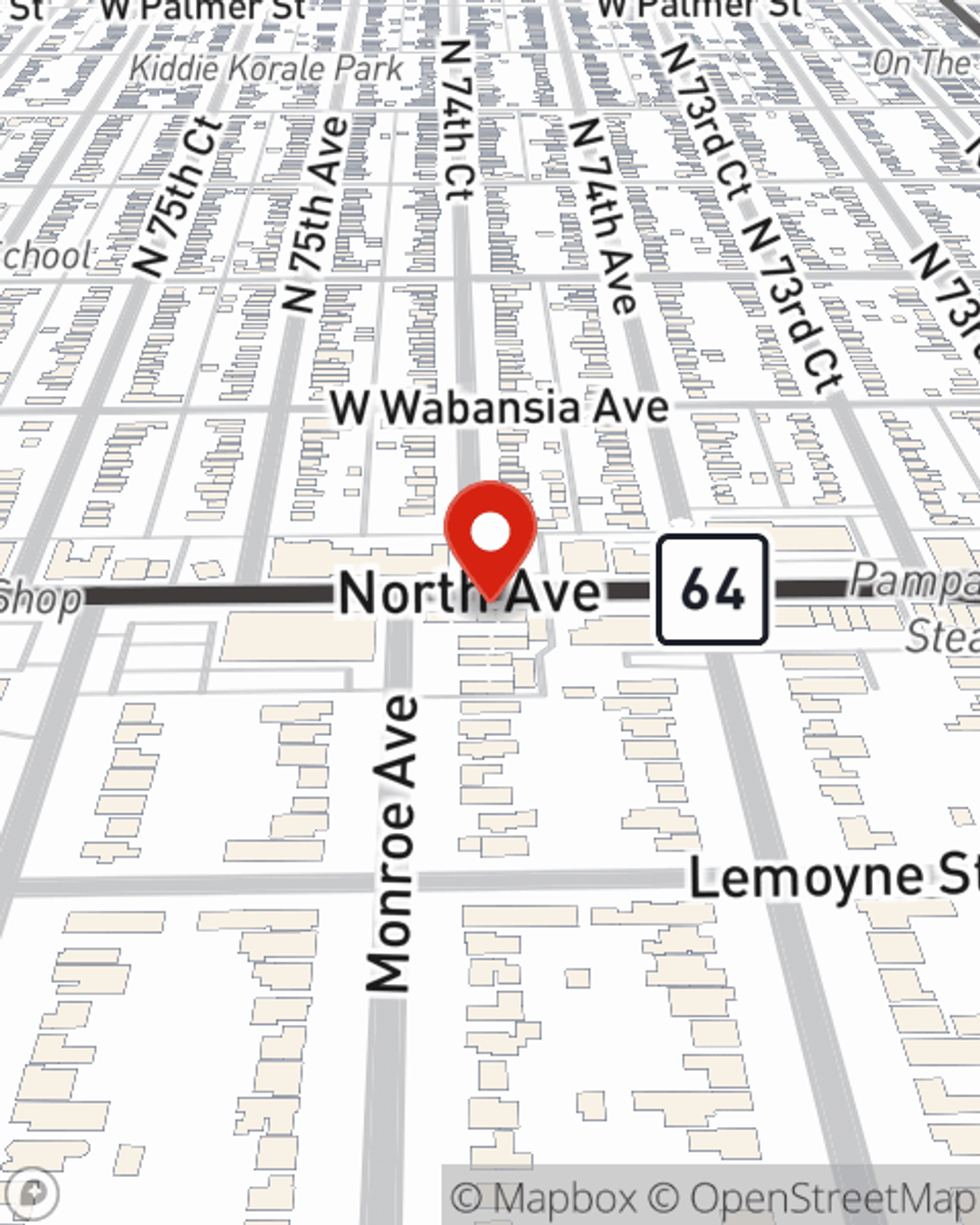

Life Insurance in and around River Forest

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent Antonette Consalvi about life insurance. That's because once you have a family, you'll want to be ready if the worst happens.

Protection for those you care about

Now is the right time to think about life insurance

Life Insurance You Can Trust

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific time frame coverage for a specific number of years or another coverage option, State Farm agent Antonette Consalvi can help you with a policy that can help cover your loved ones.

If you're a person, life insurance is for you. Agent Antonette Consalvi would love to help you explore the variety of coverage options that State Farm offers and help you get a policy that's right for you and your children. Get in touch with Antonette Consalvi's office to get started.

Have More Questions About Life Insurance?

Call Antonette at (708) 488-0410 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Antonette Consalvi

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.