Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Investment Services, Annuities

Would you like to create a personalized quote?

Antonette Consalvi

Office Hours

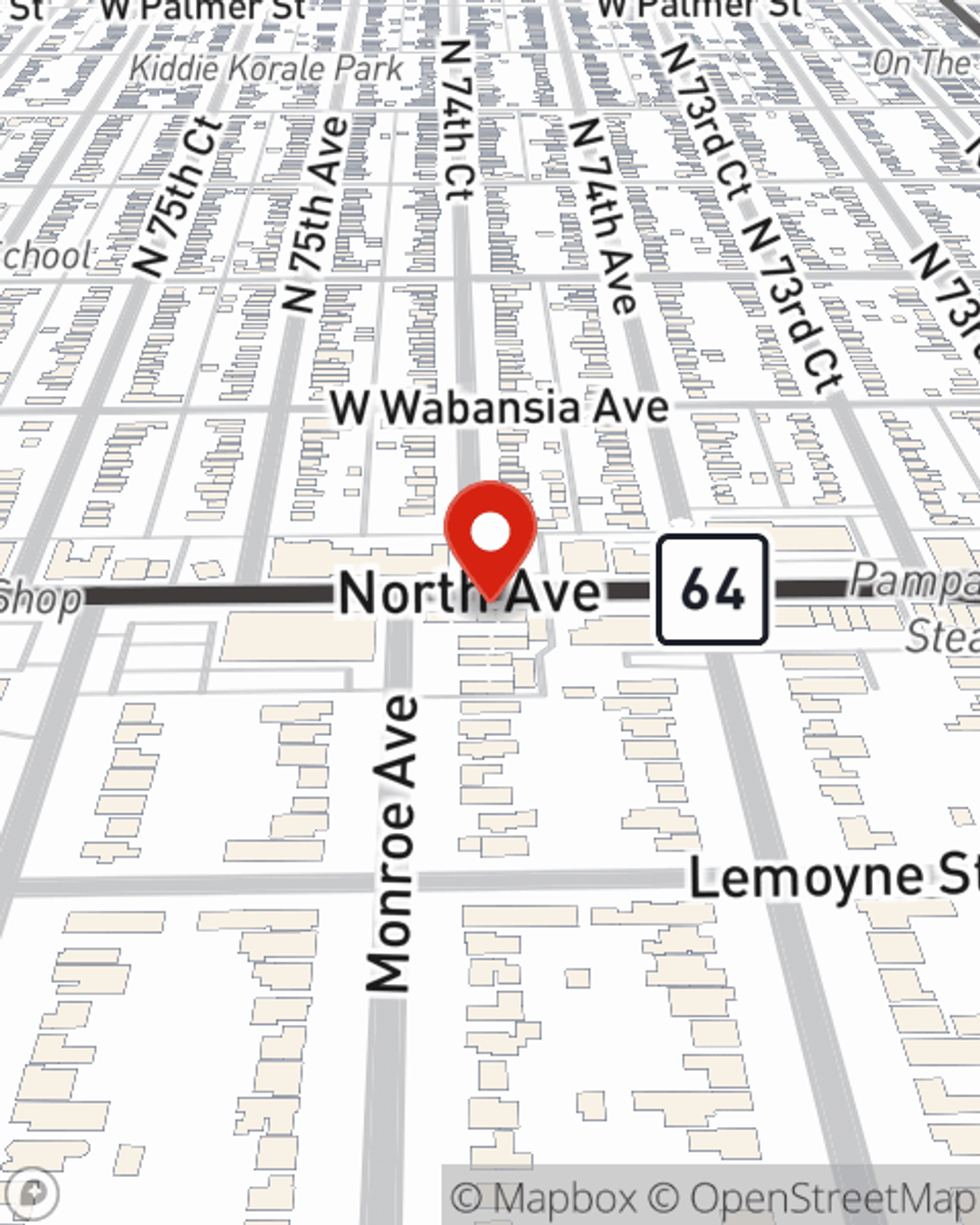

Address

River Forest, IL 60305-1131

Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Investment Services, Annuities

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Investment Services, Annuities

Office Info

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Prepare your motorcycle for storage during the off season

Prepare your motorcycle for storage during the off season

Prepping your bike can help protect it during winter motorcycle storage. Learn what to do before storing your bike.

Social Media

Viewing team member 1 of 1

Emilia Consalvi

License #21321983